If you're interested in investing but don't have the time or knowledge to manage your investments, KDi might be the solution for you. KDi (Kenaga Digital Investing) is a fully automated digital investment management platform that uses artificial intelligence to make investment decisions based on your risk profile and investment goals. With KDi, you can start investing with as little as RM100, making it accessible to everyone.

How KDi Works

KDi uses artificial intelligence algorithms to analyze and select the best investment options for you based on your investment goals, risk profile, and time horizon. Once you've opened an account with KDi, you'll be asked to complete a questionnaire that will help the platform determine your investment profile. The platform will then recommend a portfolio that's tailored to your needs and automatically invest your funds in a diversified portfolio of stocks, bonds, and other assets.

Benefits of KDi

Here are some benefits of using KDi:

- Fully automated investment management: With KDi, you don't have to worry about making investment decisions. The platform does all the work for you, making it an ideal solution for those who don't have the time or knowledge to manage their investments.

- Low minimum investment: You can start investing with as little as RM100, making it accessible to everyone.

- Diversified portfolios: KDi creates portfolios that are diversified across asset classes and sectors, reducing your risk and increasing your potential returns.

- Low fees: KDi charges a low management fee of 0.5% per annum, making it an affordable investment option.

What is KDi Save?

KDi Save is a regular investment plan that allows you to invest in a diversified portfolio of funds. The product offers a range of investment options, including equity funds, fixed income funds, and balanced funds. By investing in a mix of funds, you can reduce the risk of investing in a single asset class.

KDi Save is designed for individuals who want to start investing but have limited knowledge and experience in the field. The product offers a simple and affordable way to invest in the market. Please visit KDi save official website for more

KDI Save vs Versa vs StashAway Simple

If you're considering using KDi, you may be wondering how it compares to other digital investment management platforms. Here's a comparison between KDi Save, Versa, and StashAway Simple:

KDi Save: With KDi Save, you can start investing with as little as RM100. The platform offers a fully automated investment management service that's tailored to your investment goals and risk profile. KDi Save charges a management fee of 0.5% per annum.

Versa: Versa is another digital investment management platform that offers a low minimum investment of RM100. The platform uses artificial intelligence to create customized portfolios that are tailored to your investment goals and risk profile. Versa charges a management fee of 0.8% per annum. Feel free to checkout our Versa Referral Program if you are interested to know more.

StashAway Simple: StashAway Simple is a digital investment management platform that offers a low minimum investment of RM10. The platform creates portfolios that are diversified across asset classes and sectors, making it an ideal solution for those who want to reduce their risk. StashAway Simple charges a management fee of 0.2% per annum.

How to Invest with KDi

Investing with KDi is easy. Here's how you can get started:

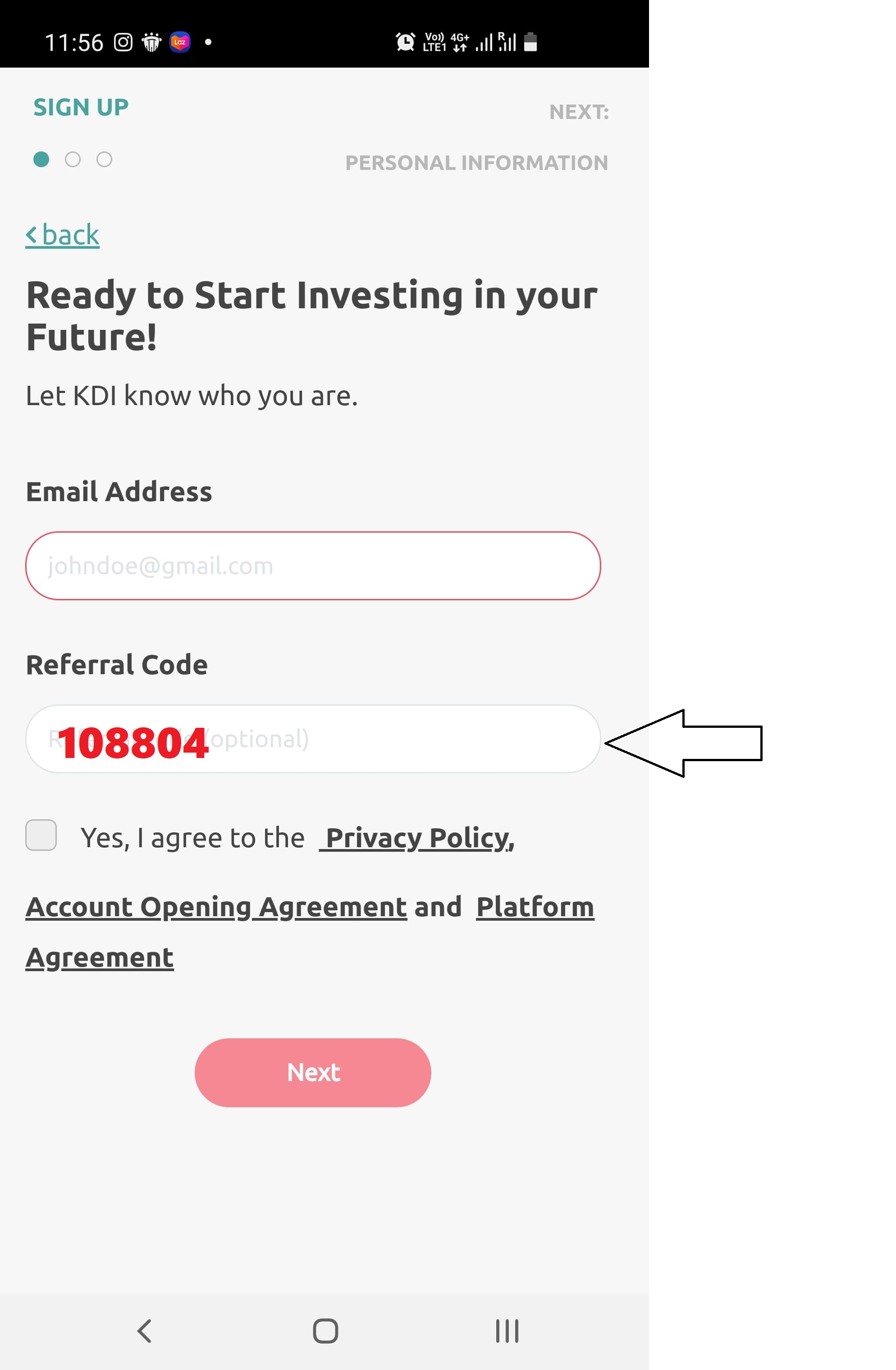

- Visit the KDi registration page and sign up for an account.

- Complete the questionnaire to determine your investment profile.

- Choose the investment amount and transfer the funds to your KDi account.

- KDi will create a diversified portfolio that's tailored to your investment goals and risk profile.

- Sit back and let KDi manage your investments for you.

How to Earn with KDi

In addition to investment management services, KDi also offers an affiliate program that allows you to earn referral bonus by referring new users to the platform. Here's how it works:

- Sign up for the KDi using KDi referral code "108804".

- Share your unique referral code with friends and family.

- When someone signs up for KDi using your referral code, you'll earn a referral bonus!

Conclusion

KDi is a fully automated digital investment management platform that uses artificial intelligence to create customized portfolios for investors. With low minimum investment requirements and affordable management fees, KDi is an accessible and affordable investment option for everyone. If you're interested in investing with KDi, visit KDi registration page to get started using KDi referral code "108804".